“Bitcoin is too slow,” people say, citing the fact that a bitcoin transaction can typically take an hour – or a day – to fully process. And that’s true.

We can all agree that it would be ridiculous to buy a cup of coffee and wait ten minutes for the payment to process. But that’s exactly what Satoshi Nakamoto specified when he invented Bitcoin.

So the question must be asked: why would someone invent a type of money that takes 10 minutes (or longer) to process a transaction? Furthermore, why would anyone use such a money?

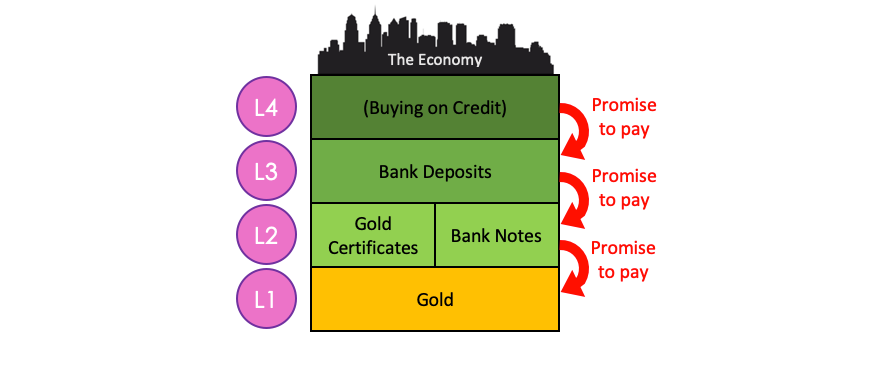

The answer lies in the surprising fact that money has layers, and each layer is designed to do something different. Here’s an example of the traditional monetary layers that existed for much of recent history:

What separates one layer from the next? The money in each layer is actually a promise to pay the type of money in the layer below.

Buying on credit (Layer 4) is actually a promise to pay bank deposits.

Bank deposits (Layer 3) are simply a promise to pay bank notes (physical bills) or, historically, gold certificates.

Bank notes (or gold certificates) (Layer 2) are promises to pay physical gold.

Gold (Layer 1) is the foundation of the monetary stack; it is NOT a promise to pay anything.

It is the supremacy of Layer 1 money that sparked the timeless quote by banker J.P. Morgan: “Gold is money. Everything else is credit.”

Why do the different layers of money exist?

The different layers emerge to satisfy the changing needs of an economy. For a sufficiently large economy, it’s practically impossible for a single layer to serve all needs. Why? Because money, like so many creations, is subject to design tradeoffs.

Layer 1, the foundation, needs to be as secure as possible and completely decentralized. If security is weak, counterfeits will erode the value of the money. If the money supply is centralized, the issuing body will inevitably act in its own self-interest at the expense of everyone else. The cost to achieve high security and full decentralization is high energy inputs, high transaction fees, and long wait times.

Layer 2, the first liability layer, needs to be fast, cheap, and scalable so that people can use it for speed-of-life transactions (e.g. buying a cup of coffee). If one version of a Layer 2 solution fails, another solution will take its place. The cost to achieve a functional Layer 2 solution is a higher degree of centralization and lower security.

Layer 3 needs to be a custodial layer. This includes holding your money and guarding against loss (accident, theft, damage, etc). The cost of a custodial Layer is more centralization and maintenance fees.

Layer 4 and beyond can have other features and applications that are beyond the scope of this essay.

Why can’t the base layer just be fast, cheap, and scalable?

The answer here touches on the tradeoffs and the incentives mentioned before: the only way to achieve something fast, cheap, and scalable (without compromising security) is to let one party have control over the accounting of balances and processing of transactions. History has shown us that centralized parties will eventually become corrupted, no matter how much they might resist. If they can create new units of money unfairly, eventually they will. If they can block or reverse certain transactions, eventually they will. If they can confiscate or “disappear” the account balances of those who might challenge their power, eventually they will. And so on. We can’t have a fast, cheap, scalable Layer 1 because we can’t have a centralized Layer 1.

So, if we have gold as a Layer 1 money, then why invent Bitcoin?

Well, we don’t have gold as a Layer 1 money. We used to, but not anymore.

A brief chronology:

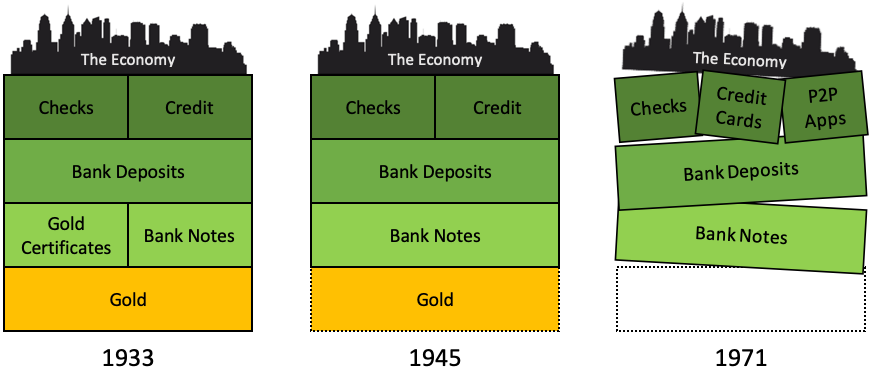

In 1913, the US government created the Federal Reserve, which began issuing “Federal Reserve Notes” (we call them “dollars” today), which were a promise to pay gold. The Fed printed way more notes than they had gold to back them up, so…

In 1933, President Franklin Roosevelt made it illegal for Americans to own gold. (By the way, that law stood for 41 years.)

In 1945, after the conclusion of WWII, the major superpowers of the world convened in Bretton Woods, New Hampshire and decided that the major currencies of the world would be backed by US dollars, and US dollars would be backed by gold. But keep in mind that Americans were still forbidden from owning gold. So this was a phony gold standard at best. Just like before, the Fed printed more dollars than they had gold to back them up, so…

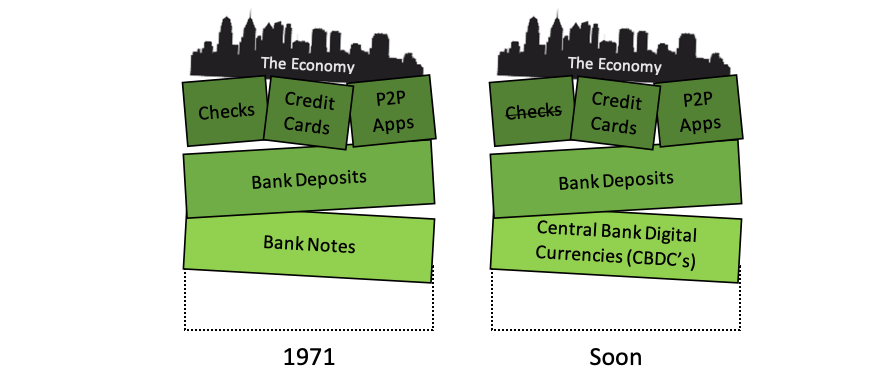

In 1971, President Richard Nixon “temporarily” suspended the convertibility of dollars into gold. That “temporary” suspension happened over 50 years ago, and it is still suspended today. This effectively pulled out the single bottom block on the Jenga tower of the economy, and the United States – economically and socially – has been collapsing in slow motion ever since. Don’t believe me? Spend some time browsing this website, and you’ll begin to consider that most of society’s ills stem from that fateful day in 1971.

So how do we fix this?

As you can probably guess, this is exactly what Satoshi Nakamoto wondered. He knew that it wasn’t enough to just get governments to go back onto the gold standard… because they’ll just leave it again. There must be a digital version of gold that everyone in the world can use – and continue to use – even when governments abuse it, abandon it, or outlaw it.

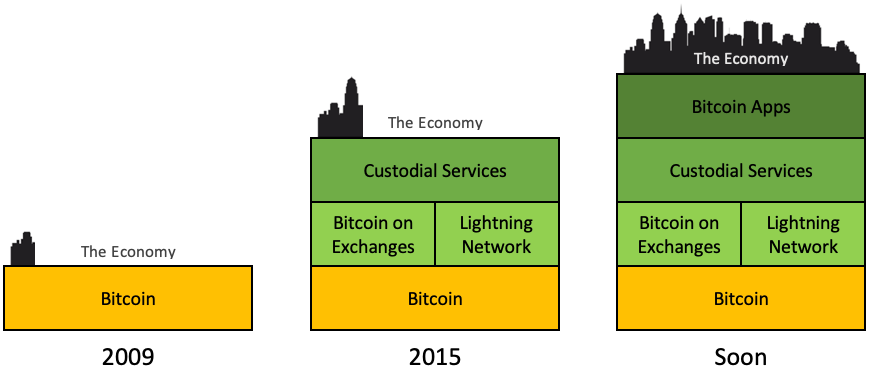

Enter Bitcoin. The Layer 1 money of the digital age.

As a Layer 1 money, Bitcoin would have to be as secure as possible and completely decentralized. Satoshi knew, therefore, that he would have to sacrifice speed, cost, and scalability to achieve his goal. Those other attributes would be achieved through Layer 2 solutions.

And that’s exactly what has happened:

Centralized services such as cryptocurrency exchanges and the Lightning Network have emerged to help users send and receive bitcoin nearly instantly, with near-zero cost and near-zero energy.

Soon, Bitcoin apps will be developed that allow payment in bitcoin for everything from coffee and groceries to mortgages and rent to ride sharing and airline tickets.

What about other cryptocurrencies like Ethereum, or Central Bank Digital Currencies (CBDC’s)?

All other cryptos (at least the dozens of them that I’ve studied) are one of two things: securities (like stocks, which we haven’t discussed in this essay), or digital fiat, which is like the Layer 2 currencies from 1971. How do I know? Because they’re all trying to be fast, cheap, and scalable! To achieve this, they must sacrifice decentralization, which means that a single entity or a group of entities holds special privileges on each of these networks. For this reason, they cannot serve as Layer 1 money. Furthermore, they don’t promise to pay any form of real money, so they’re a “floating” Layer 2 at best. Quite simply, they cannot be the base of an economy that’s any healthier than the one we have now (and recall, the one we have now is woefully sick).

Thanks for reading. I hope the above discussion was valuable to you. If this essay triggers any further questions about money in general or Bitcoin in particular, please ask in the Comments! Perhaps your question will become the subject of my next essay… ;)

Very interesting. I didn't know this way of looking upon Bitcoin and the role it plays. I am much wiser after I have red this. Thanks a lot.

I enjoyed reading this, Alan. I think it's really well developed and clearly written. And it's packed with tons of ideas everyone should be curious about today. I happen to 100% agree with all you say here, and I'm shocked at how many people aren't aware yet that the world is in a state of monetary fraud.